3% of property purchase price + 60,000yen (excl. Consumption Tax) is charged on both buyer and seller.

Each side has each different agent/broker, or same agent/broker take care of both sides in Japan.

Taxes related to the real estates (for the buyer) are mostly :

* Fixed Asset Tax

1.7% of the officially appraised amount by authority

(1.4% Fixed Asset Tax and 0.3% City Planning Tax)

* Real Estate Acquisition Tax

1.5% of land price / 2% of building price officially appraised by authority

* Withholding Tax

10.21% of the actual property purchase price

– This Withholding Tax is in case you are purchasing the property from the foreign non-resident owner (seller). This tax is not charged in case the property price is JPY100M or less, “and” if you are purchasing the property for the residential living purpose.

If you pay this tax, the tax amount is deducted from the property sale price and the the amount minus this tax is paid to the seller.

These are just the regular information. You have to consult with the accountant finally for your case. No one else but accountant can advise the tax matters in Japan. The important point is finding the accountant who speaks English well and has experiences to take care of the cases with foreign customers.

We have some English speaking Japanese accountants to be introduced to you.

Fire insurance premium decided by the events of natural disasters in Japan.

The amount for the type of property is usually different.

It is much more reasonable for residential house with residents than empty house (Akiya) with no one living with more risk.

The amount for holiday houses / apartments is much higher than even the empty houses (Akiya), since it is business usage with possibly unspecified large numbers of people.

We have some English speaking Japanese insurance sale to be introduced to you.

Akiya, the vacant, aged house in some rural area of Japan, is getting popular among some foreigners lately.

The price of the property is rather reasonable and some are even close to for free of charge or extremely cheap.

There always are somme reasons to have such price setting whether that is because of the inconvenient location or even dangerous location.

Still, some are simply just old and depreciation completed at reasonable prices. The decent renovation may revive the property possibly with some investment and effort of the owner.

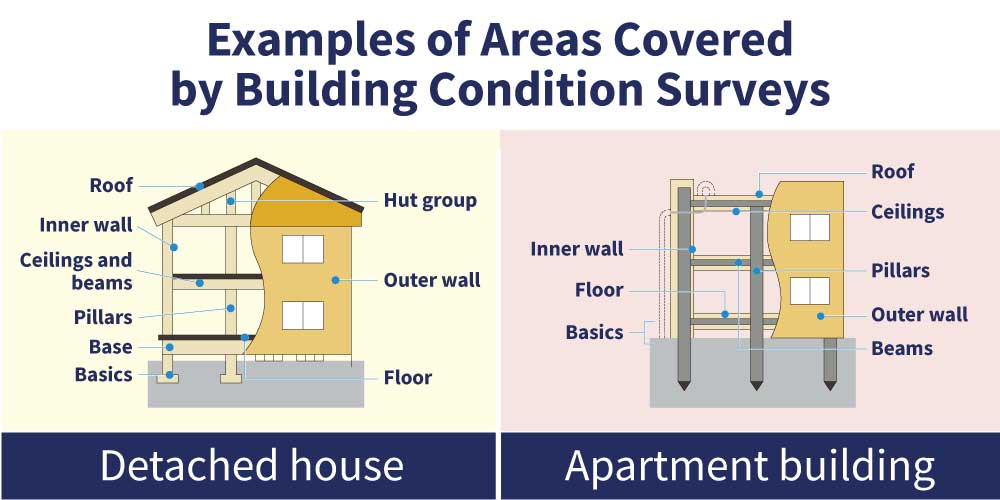

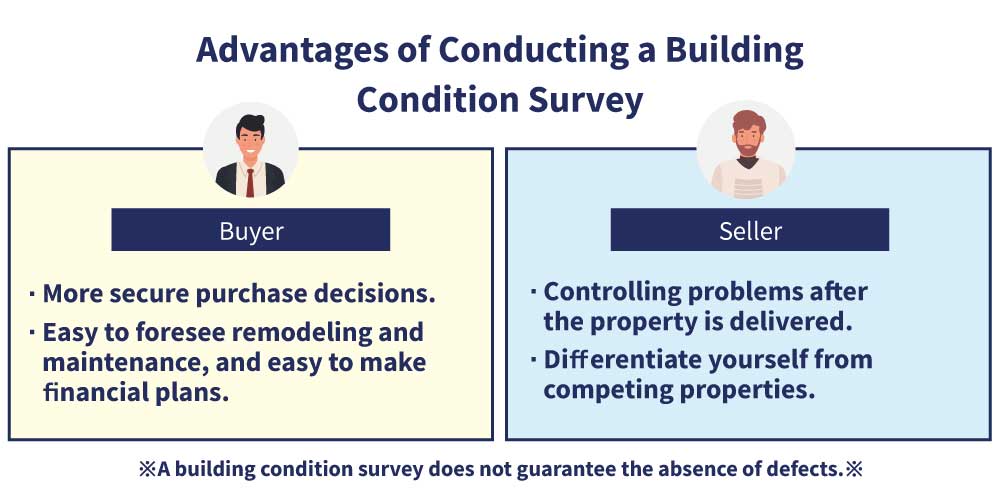

It is rare to have the house inspection when you purchase the house property in Japan, although there are those qualified house inspector who can check the major structures of the building and make the report. The government encourages to use the house inspectors but it has not been yet in common in the process of real estate purchase. One reason would be the sale condition of the existing home property usually includes the sale with as-is condition. It still would be a good to know what possible matter there would be by hiring a house inspector to be checked. There would be only few services provided in English even the report that they make. Still it may help you with the photos on the report and some translation software and services lately.

Buying the land which category is “agricultural land” or “agricultural field” in Japan would give you a bit hard time to understand what it is and how different the process of purchasing it.

The details of the process will be informed to you, but what you have to know first is you will need at least “bank account balance certificate”, and “the building plan with its cost estimation”.

Also, it takes 3 months to go through at least if everything is going well and you could talk to architect and construction company well to make the plan smoothly.

With these further steps than the one to buy the other regular category of lands, and some more time than that, you can purchase it.

There are some areas where the authority specifies the agricultural growing area where it has strict regulations to change the category of the lands. For those areas, mostly it is difficult to purchase the lands for foreign nationals.

Realty Japan ® provides

the property information through Japan.

Realty Japan ® provides the property information through Japan.

Get notified of new listings and receive all the latest real estate news from Japan to your inbox

Realty Japan ® provides

the property information through Japan.

Realty Japan ® provides the property information through Japan.

Quick Links

Agents/Brokers

Get notified of new listings and receive all the latest real estate news from Japan to your inbox